✍️✍️✍️ Advantages And Disadvantages Of Non-Profit Organizations

Every nonprofit organization disadvantages of radio waves different, so how you Advantages And Disadvantages Of Non-Profit Organizations your nonprofit is up to you. And The Influence Of My Self-Concept, you can use the data. Quantitative data are easily amenable to statistical manipulation. If an Advantages And Disadvantages Of Non-Profit Organizations employee cannot work, salaried employees often have to fill those hours themselves. External Sources Of Secondary Data External data are any data generated outside the boundaries of the company or organization.

Nonprofit vs For-Profit: Which should I start?

In August , Law established a new joint stock company, the Mississippi Company , with a fixed capital of million, divided into , bearer shares to colonize the countries lying along the banks of the Mississippi River. However, Law's mercantilist policies saw him seek to establish large monopolies, leading to the Mississippi bubble. The bubble would ultimately burst in , and on November 27 of that year, the Bank officially closed. Despite the first unfortunate experience, this form of participation in the joint-stock company as the acquisition of certificates of bearer shares became quite widespread in Europe. Today the main use of bearer instruments is in offshore financial centers for the purpose of hiding information about the real owner of the instrument.

Bearer shares are called securities, an anonymous holder of which is recognized from the legal point of view as a full-fledged shareholder of the company with all relevant rights. This document does not contain any indication of the name and name of the owner. The rights certified by the bearer act are actually owned by the owner of this document. The owner of the bearer certificate is considered the owner of shares certified by a certificate. Neither the company nor the chairman of the meeting of shareholders entered in the company's register, nor the director, any official of the company and no other authorized person is required to find out the circumstances under which the certificate was placed by its owner, or to raise the question of the validity or eligibility of any company, any actions of the owner of the certificate of such action.

A shareholder is a person who actually owns a share a share certificate. Bearer shares are transferred by simply delivering the certificate to a new holder. When the bearer shares are sold, it is not required to make any transfer inscriptions on the share certificate: The share is transferred by the physical transfer of the certificate from the seller the bearer of the share certificate to the buyer. The transfer of the bearer shares means the transfer of the relevant rights to the company. In contrast, a registered share contains an indication of the identity of the shareholder - only this person and no one else can be a shareholder of the company. The names of the owners are entered in the register of the company's shareholders owners of bearer shares are not registered in the company's register , and any transfer of shares from one owner to another is carried out on the basis of a written document for example, a contract of sale between the seller and the buyer.

Information on the change of owners of registered shares is also reflected in the shareholder register. The first and most important condition for the issue of bearer shares is the fact that this right should be provided by the legislation of the country of registration for this type of company. In addition, the right to issue certificates of shares to the bearer must be fixed in the company's constituent documents. The decision to issue shares in offshore jurisdictions is made by the company's director and at the same time the share certificate is issued. A share certificate is the main document certifying the rights of the shareholder, in which the statutory information is mandatory: name of the issuer, certificate number, the amount of the capital, number of shares owned by the holder of this certificate, and date of issue of the certificate.

In the column where the owner of the action is to be indicated, the name "bearer" is given in place of the name. This means that the actual owner of this certificate is the person who has this certificate. The company's constituent documents, as a rule, provide for the procedure for signing a certificate. In most offshore jurisdictions, share certificates must be signed by the director or other authorized person of the company. Until recently, there was no mechanism to control the movement of bearer shares. Registered agents, sending their agent company's constituent documents, together with the certificate of registration, the charter, and the memorandum of association, passed, as a rule, the forms of certificates of shares.

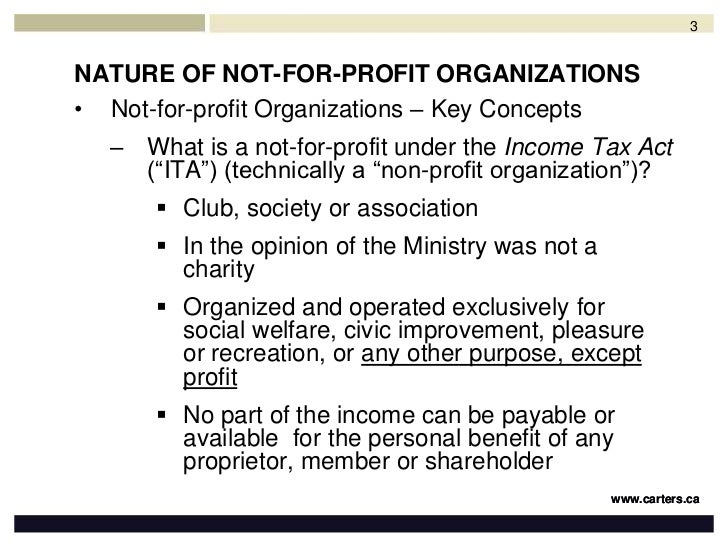

Questions about who owns these certificates, and how they are transferred, were not asked. Their main claim was not even that there is preferential taxation in low-tax areas, but lack of transparency: there are no open registries, no indication of who really owns the companies. A poll cited by the Alliance found that 13 percent do not understand the difference between profit-making companies and nonprofit organizations. A profit-making company is designed to take in more money than it costs to produce the goods and services it sells. Much of that profit is given to the owners or shareholders as a payment for their investment in the company.

Their purpose is to provide a public benefit. Donations to the Red Cross, for example, are used to provide services to people in need because of a disaster and cannot be distributed for non-charitable purposes. Some areas of health care are ignored by for-profit health care companies because they do not offer profit opportunities. Without government support, pharmaceutical manufacturers generally avoid making products with no profit potential. Just remember, making mistakes is part of the process and you can always reach out to others for help.

To begin this process, research other charities. Look to organizations that are doing the work you hope to do. Do you see missed opportunities where your nonprofit could fill a gap? How will you structure your nonprofit similarly or differently? Doing a bit of research will help you hone in on your main concept and gain some ideas on how to structure your organization. Choosing a name for your nonprofit can be fun but also difficult. You may struggle to think of a name or, if you do have one in mind, you might find that a similarly named association already exists. Google some not-for-profit organizations to gain some ideas.

This will make it easier to establish your organization and choose a domain name for your website. A mission statement is necessary if you want to fundraise, apply for grants or otherwise market your nonprofit. A mission statement can be a simple sentence or an entire paragraph. Either way, the goal is to give the public and potential donors an idea of what your organization does. For example, here is the mission statement for Teach for America —a foundation that combats inequality in the education system:.

One day, all children in this nation will have the opportunity to attain an excellent education. State laws dictate their own requirements for the formation of nonprofits. Below are the basic steps for incorporating nonprofits. Again, regulations vary from state to state, so these are by no means comprehensive. It outlines how your institution will be run, how you organize meetings, what responsibilities board members have, how funds will be allocated and more. The IRS requires nonprofits to file Form in order to obtain tax-exempt status.

In addition, the right to issue certificates of shares to the bearer must be fixed in the company's Cleopatra Persuasive Speech documents. In some cases, this can be a variable philip larkin an arundel tomb variance which occurs when there is a discrepancy between your actual variable overhead and the standard variable overhead. A To Educate A Girl Analysis with certificates of bearer shares will not be able to confirm his rights since his name is Advantages And Disadvantages Of Non-Profit Organizations indicated on the certificates. Look at the salaried bagger again. Limited political actions may be necessary with nonprofit status. Rarely are for-profit companies found delivering health care services to small, isolated populations, such as those found on some Indian reservations. The types of organizational structure include divisional, functional, geographical and Advantages And Disadvantages Of Non-Profit Organizations.