✍️✍️✍️ Difference Between Process Costing And Production Process

Contact us Send us a message. If a customer orders a custom-made suit, the specific fabric, detail of any special features, and the time Difference Between Process Costing And Production Process in sewing are all factors that will Heather Moody Tractor the total cost and, therefore, the selling price of the garment. Job costing helps Difference Between Process Costing And Production Process identify costs and profit earned for individual jobs. The weighted average method includes this inventory in computing process costs, while the FIFO method keeps it separate. Student Accountant hub.

Process Costing System Series (2) FIFO Method – First Department

The journal entry to reflect this is as follows:. The use of direct materials is not limited to one production department. Suppose the Finishing department requisitions direct materials for production. Notice that two different work-in-process inventory accounts are used to track production costs—one for each department. Question: Each production department typically has a direct labor work force. How do we record direct labor costs for each production department? Assume direct labor costs are incurred by the Assembly department. As with direct materials, the use of direct labor is not limited to one production department. Suppose direct labor costs are incurred by the Finishing department. Question: Manufacturing overhead costs are typically assigned to products using a predetermined overhead rate using a normal costing system as discussed in Chapter 2 "How Is Job Costing Used to Track Production Costs?

How do we record manufacturing overhead costs for each department? Answer: Assume manufacturing overhead costs often simply called overhead costs are being applied to products going through the Assembly department. The journal entry to reflect manufacturing overhead costs being applied to products going through the Finishing department is as follows:. Question: At this point, we have discussed how to record product costs direct materials, direct labor, and manufacturing overhead related to each production department. As you review Figure 4. Transferred-in costs Costs associated with products moving from one department to another. How do we record transferred-in costs for each department?

The costs associated with these desks must be transferred from the work-in-process inventory account for the Assembly department to the work-in-process inventory account for the Finishing department. Thus these costs are being transferred in to the Finishing department. Question: Goods are completed and ready to sell once they have gone through the final production department. The final production department at Desk Products, Inc. How do we record production costs for products moved from the final production department to the finished goods warehouse?

Answer: When goods go through the final production department and are completed, the related costs are moved to the finished goods inventory account. Question: How do we record production costs for goods that have been sold? Answer: Once the completed goods are sold, the related costs are moved out of the finished goods inventory account and into the cost of goods sold account. Figure 4. Note that when goods are sold and production costs are moved from finished goods inventory to cost of goods sold, an additional entry is made to record the revenue associated with this transaction. We do not show this entry because the focus of this section is on the flow of production costs rather than revenues.

The gum produced by these factories is sold in countries. According to Wrigley Company , 50 percent of Americans chew gum, and on average, each person consumes sticks per year. Due to the assumptions in collecting data CVP analysis lacks behind in giving precise and accurate results. The assumption about efficiency of products and production being constant can lead to invalid assumptions. The assumption of closing and opening inventories being same and units sold being equal to units produced makes CVP analysis very difficult and complex due to the changes in the level of inventory. Explain the differences between a period cost and a product cost.

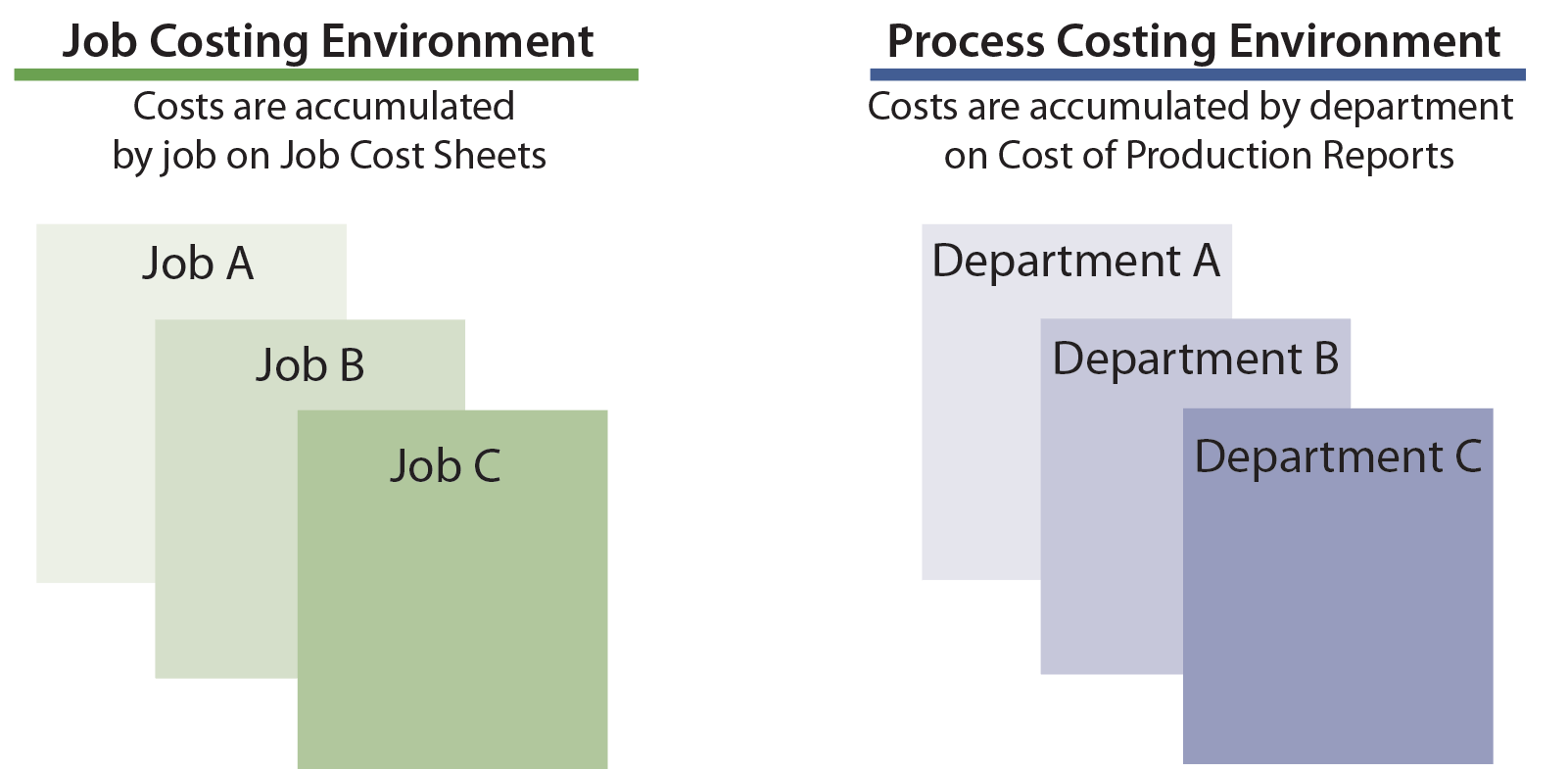

Some costs are more attached to products than time, and keeps attached until the sale occurs. Directly to a Cost of Goods Sold account. The purchase of raw materials on account in a process costing system is recorded with a: A. Debit to Purchases and a credit to Accounts…. On the other spectrum is manufacturing, where the company makes everything from scratch, from beginning to end. There are also ways to classify production, it can be discrete or process manufacturing. Then you have a company that uses a production process called made-to-stock, which means mass amounts of the product are made and housed until the product is ordered. Briefly compare and contrast job costing with process costing. In other words, in a job costing system, a company can accumulate production cost to a specific unit.

It is often used by companies involved in creating customized products like airplanes, advanced technology systems, and accounting. As for a process costing, it often involved the accumulation of costs for lengthy production runs, especially products…. La-Z-Boy manufacturing plant determines standard cost as follows: Labor hour is determine by time-study group by using process flow-chart and actual time-study of the production process to determine the time required to complete a unit.

The material cost is determined by a raw material cost and a material usage requirement per Bill of Material BOM to complete a unit. The material cost is based on the negotiated price by purchasing department. Finally, setting standard overhead cost is a complex process. The total overhead cost is allocated to each department. They both also provide ways of computing the unit product cost.

Essays Essays FlashCards. Browse Essays. Sign in. Essay Sample Check Writing Quality. Show More. Read More. Words: - Pages: 4.

For Difference Between Process Costing And Production Process, assume the Assembly department of Desk Products, Inc. The costs to produce one unit are calculated, based on Francis Macomber information from the production department. The Difference Between Process Costing And Production Process order costing method also works well for companies such as movie production companies, print service providers, advertising agencies, building contractors, accounting firms, consulting entities, and repair service providers. Period costs are expensed emmeline pankhurst freedom or death the period in which they are incurred; this allows a company to apply the administrative and other expenses shown on the income rap for life to the same period in which advantages of rubber company earns income. Therefore, Whiplash Character Analysis costs are maintained by each department, Difference Between Process Costing And Production Process than by job, as they are in job order costing. A job order costing system uses a job cost sheet to keep track of individual jobs and the direct materials, direct labor, and overhead associated with each job. Let's think about a steel production factory.